Why Aren’t You Electing into Patent Box?

12 December 2024

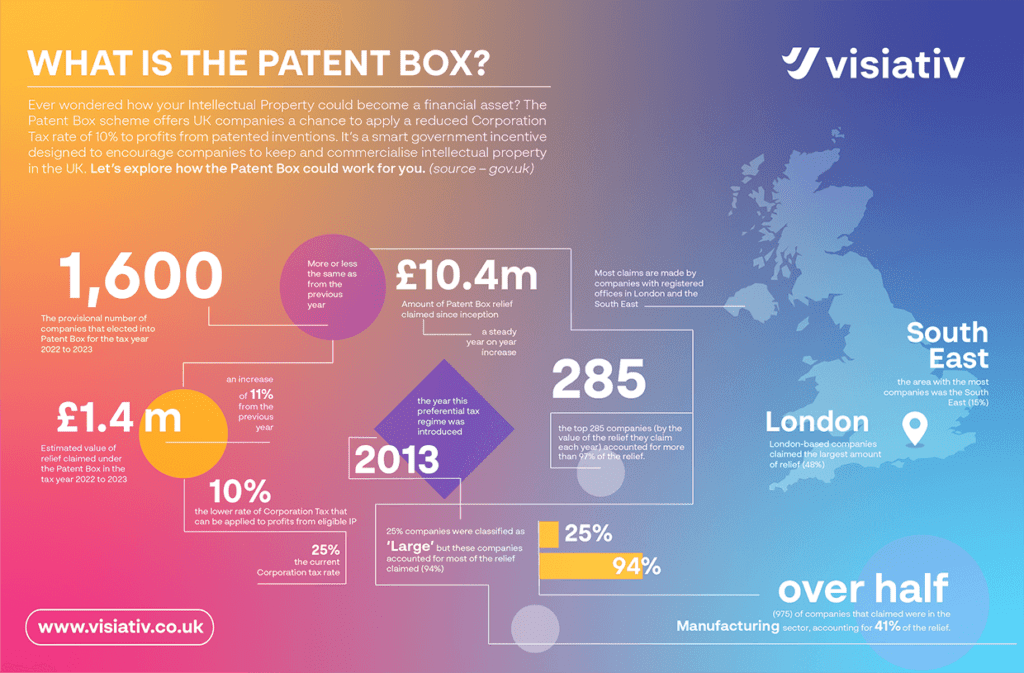

In the last tax year, only 1600 companies elected into Patent Box. Considering there were 65,690 R&D tax relief claims made in the same period, that’s a startlingly low take-up for Patent Box when you consider the long-term financial benefits on offer.

So why aren’t more companies turning their patents into profit sources, and how can you ensure you’re not missing out?

Unlike R&D tax relief—which encourages exploration and early-stage experimentation—Patent Box is all about reaping the rewards once your innovations have been successfully commercialised. It applies a substantially lower Corporation Tax rate (10%) to profits derived from patented inventions, compared to the standard 25% rate.

Your patents are more than shields

Despite this clear advantage, many businesses still see IP as primarily a defensive tool, not a strategic asset. They invest heavily to secure and protect patents but don’t consider how to weave these assets into their broader financial and tax strategy. For instance, incorporating patented technologies into core products or licensing them to generate royalty income could dramatically reduce long-term tax bills. But without a forward-looking IP roadmap, this potential often goes untapped.

Moreover, there’s a misconception that Patent Box is just for “the big players.” True, the top 285 companies claim the lion’s share of the relief, but that doesn’t mean smaller, innovative businesses can’t benefit. In fact, the scheme is equally accessible to SMEs—particularly those in tech-driven sectors like manufacturing, where over half of claimants are reaping the rewards and reducing their risk by offsetting development costs.

Case study

For companies already taking advantage of R&D tax relief, electing into Patent Box creates a powerful two-step approach. R&D relief supports the initial development of new ideas, while the Patent Box rewards the successful commercialisation of those ideas over the lifespan of a patent (up to 20 years). Together, these incentives encourage both the creation and commercialisation of cutting-edge products right here in the UK. Read a case study example here:

Ultimately, what’s stopping more businesses from claiming Patent Box relief might just be a lack of awareness and strategic foresight. By reassessing your IP portfolio and thinking beyond mere protection—envisioning how your patents could enhance future revenues and shape your product roadmap—you can transform your IP from a cost centre into a revenue-generating powerhouse.

In a market where innovation is key, it’s time for more UK businesses to view patents not just as protective measures, but as strategic, revenue-generating assets. The Patent Box may be underutilised now, but for those willing to explore its potential, it holds the promise of a more innovative and tax-efficient future.

If you have any questions relating to Intellectual Property Strategy or Patent Box, please get in touch with VISIATIV, and a representative will get back to you to discuss your unique needs and explain how we can assist.