R&D Tax Credit Changes - Which Scheme Applies to me?

30 May 2024

Types of R&D tax relief — accounting periods beginning before 1 April 2024

There are 2 different types of R&D tax relief, depending on the size of your company and if the project has been subcontracted to you or is subsidised, or both.

Small and medium-sized enterprise (SME) R&D tax relief

You can claim SME R&D tax relief if you’re a SME with both of the following:

1.less than 500 staff

2.a turnover of under 100 million euros or a balance sheet total under 86 million euros

You’ll need to include partner and linked enterprises when you work out if you’re a SME.

For qualifying expenditure incurred on or after 1 April 2023, you can claim the higher 14.5% tax credit rate if you meet the intensity condition with an R&D intensity of at least 40%.

R&D expenditure credit

Large companies can claim expenditure credit for working on R&D projects.

It can also be claimed by SMEs who have been subcontracted to do R&D work by a large company or have subsidised expenditure.

Types of R&D tax relief — accounting periods beginning on or after 1 April 2024

There’s one merged scheme for all companies.

Also an additional scheme with a more generous basis of calculation for only loss-making R&D intensive SMEs.

The expenditure rules are the same for both forms of relief. Where work is done under contract, the party that initiated the R&D project is generally the party that can claim.

For more information, read R&D tax relief: the merged scheme and enhanced R&D intensive support.

Merged scheme for R&D expenditure credit

Any size of company doing qualifying R&D can claim under the merged scheme.

Enhanced R&D intensive support

Enhanced R&D intensive support is calculated in the same way as the SME scheme before 1 April 2024.

You can claim enhanced R&D intensive support if:

1.you’re a SME with:

- less than 500 staff

- a turnover of under 100 million euros or a balance sheet total under 86 million euros

2.you make a trading loss for tax purposes before relief is calculated

3.you meet the R&D intensity condition, with an R&D intensity of at least 30%

The same expenditure rules apply as for the merged scheme.

You can download our PDF for more information on R&D Intensive SMEs.

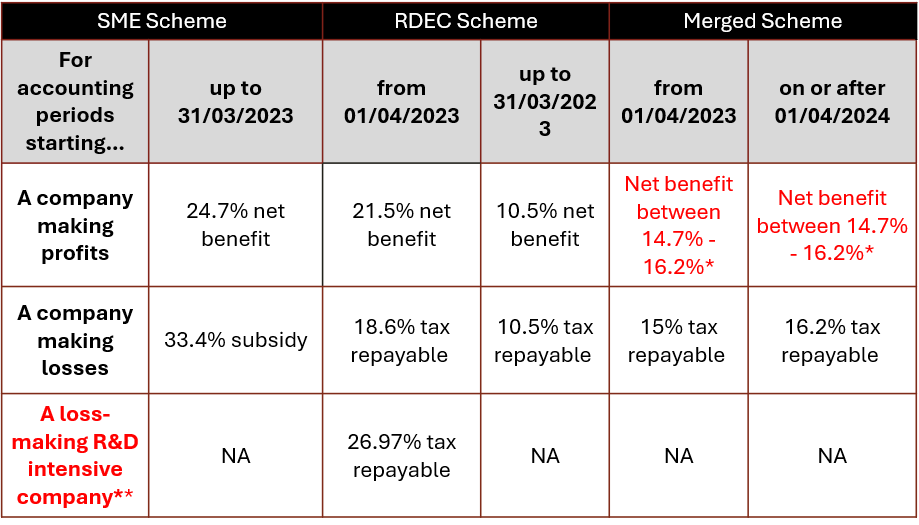

Which scheme applies to me?

“For accounting periods starting…” can cause confusion.

It relates to the starting point of whichever accounting period (the timeframe used for Corporation Tax calculations) you chose for your business.

Changes that apply “for accounting periods beginning on or after 1 April 2024”, come into effect for the start of the accounting period that starts on or after this date – whenever that might be.

For example, if your current accounting period ends on 30th September 2024, the new merged R&D scheme rules would apply to your business from 1st October 2024.

* The post tax RDEC/Merged rates from 1 April 2023 will vary depending on the level of taxable profits a company has and corporation tax applied to those profits. The Net RDEC at the main rate of CT (25%) is 15%, for the small companies rate (19%) is 16.2% and for companies paying tax in the marginal rate band (26.5%) is 14.7%.

**Loss-making R&D intensive companies are those whose qualifying R&D expenditure constitutes at least 40% (from 1 April 2023) or 30% (from accounting periods starting on or after 1 April 2024) of total expenditure (splitting accounting periods as required). Total expenditure for this purpose will be calculated from the total expenses figure in the profit and loss (P&L) account, adjusted by adding any amount of expenditure used under s1308 Corporation Tax Act (CTA) 2009 and by subtracting any amount not for CT purposes.

Due to the complexity and scale of the changes, we have further information available for the following schemes:

- R&D Intensive scheme

- Overseas Subcontracting and EPW Restrictions

- Subcontracting