Ask the Expert – How to fund an innovation project from start to finish

17 October 2024

Looking for the best way to fund your innovation project from start to finish? This month, we’re speaking with Jennifer Stenhouse, Innovation Funding Specialist at Visiativ, about the best ways a business can access the right funding at each stage of an innovation project – from early development to commercialisation.

Q | Hi Jennifer – what funding options are typically available at the very start of an innovation project?

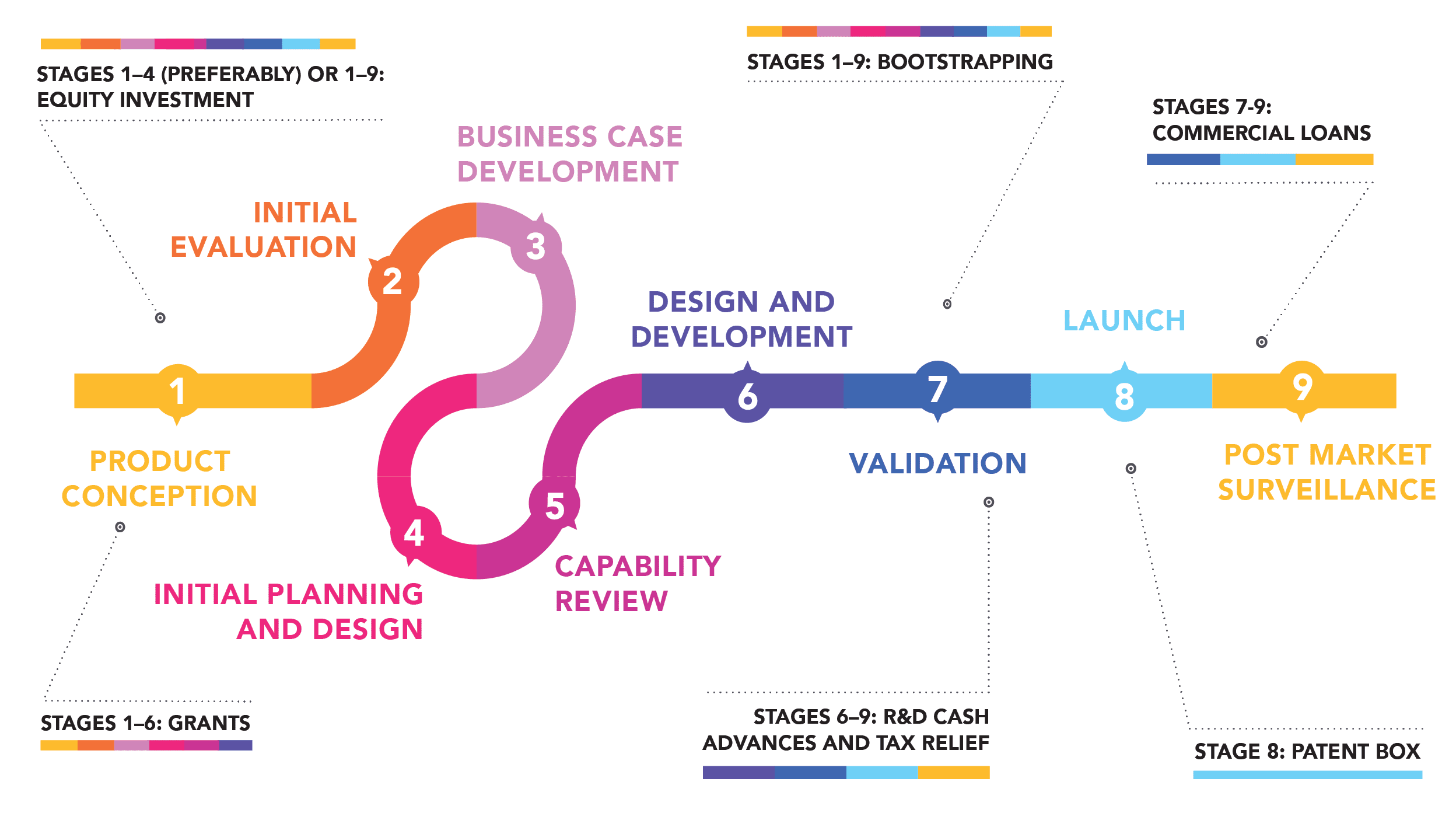

Well, at the very start, most companies rely on bootstrapping. This means using internal resources or personal funds, which might include money from friends or family. Bootstrapping is often used to meet early milestones and demonstrate commitment to the project. And, in some cases, businesses also look for early equity investment, especially when the technical risks are high. Equity investment doesn’t just provide financial backing but can bring valuable expertise and strategic guidance, especially in areas where the management team may have gaps.

Q | Once the project has moved past its initial stages, what other funding options become available?

At that point, I think it’s worth exploring grant funding. Grants are ideal for early-stage innovation because they focus on supporting technical challenges and risks. The more ambitious and technically complex your project is, the better the chances of securing a grant. However, the sheer number of grants out there can be overwhelming, and writing a strong application is no small feat. My advice would be to seek professional help in identifying the right grant and crafting a proposal that really stands out.

Q | As projects progress and get closer to the market, what types of funding are businesses turning to?

As a project matures and begins to approach commercial viability, commercial loans become more relevant. At this stage, the technology or product is typically more developed, and the business has a clearer path to market. Lenders feel more comfortable offering loans because the risks are lower by then. If your business has recurring revenue, securing loans against assets like sales invoices or intellectual property can be a good option. And for businesses without traditional revenue streams, there are lenders who are more flexible and willing to secure loans against things like IP or even software.

Q | What about R&D tax credits? How do they fit into this process?

The great news is that R&D tax relief can be an ongoing source of support throughout the entire development process. As companies tackle technical uncertainties and innovate, much of their work will qualify for R&D tax credits. This relief allows businesses to claim back a portion of their eligible R&D costs, helping to free up cash flow and fund further development. For many businesses, R&D tax relief becomes an essential tool to fuel continuous innovation, especially in long-term projects.

Q | Finally, when a company is ready to commercialise a product or technology, what funding options should they consider?

When you’re at the commercialisation stage, Patent Box relief is definitely something to look into if your project has led to a patentable invention. The Patent Box scheme allows you to pay a reduced corporation tax rate on all profits associated with the commercialisation of a patent registered with the UK or European Patent Offices, over the life of the patent. While this obviously comes too late to deliver funding for current development projects, Patent Box is an excellent way to generate additional funds for future innovation.