Aerospace & Defence R&D Tax Credits

We can support your company throughout the entire lifecycle of an Innovation project, from IP Management and Grant Funding, to R&D Tax Relief and Patent Box.

Funding and Innovation support for the Aerospace and Defence sector

There are many strategies available to AD&S companies to fund and monetise innovation: Intellectual Property (IP) management is crucial for protecting inventions, designs, and technologies through patents, trademarks, and copyrights, enabling licensing and commercialisation for revenue generation.

Exploring grant funding opportunities from government bodies and private organisations can provide support for research and development initiatives. R&D tax relief schemes offer tax incentives, reducing the financial burden of innovation investments.

Finally, the Patent Box regime provides a reduced tax rate on profits from patented inventions, incentivising companies to develop and commercialise patented technologies.

Explore Innovation Support Strategies for Aerospace and Defence

We can support your company throughout the entire Lifecycle of an Innovation project

-

Explore now

Explore nowIntellectual Property

Intellectual Property (IP) protection not only safeguards the innovators’ rights but also provides a platform for licensing and commercialisation, enabling revenue generation.

-

Explore now

Explore nowGrant Funding

Grant funding is a significant source of finance for the Aerospace & Defence industry, effectively reducing the economic risks linked to the research & development of new cutting-edge technology.

-

Explore now

Explore nowR&D Tax Relief

Tax incentives for companies investing in innovation, reducing the financial burden associated with research and development activities.

-

Explore now

Explore nowPatent Box

The Patent Box regime provides a reduced tax rate on profits generated from patented inventions, incentivising companies to invest in the development and commercialisation of patented technologies.

Intellectual Property (IP)

Intellectual Property (IP) protection not only safeguards the innovators’ rights but also provides a platform for licensing and commercialisation, enabling revenue generation.

Intellectual Property & company valuation

In recent years, intangibles (including intellectual property such as design rights, industrial secrets, trademarks and patents) have played an increasing part in company valuation. In 2020 intangibles were estimated to represent 70% of global company value. A study by the European Patent Office in 2021 also showed that companies which own at least one patent, registered design or trademark generate on average 20% higher revenue/employee than those without any IP rights.

Given this backdrop, it’s important that management teams in aerospace and defence sectors are aware of the IP within their business and they have a plan to effectively exploit this

Our IP team can help you develop a winning IP strategy

-

IP audit

- What IP do we own and use

- How do we use it to best effect

- What IP is critical to our future success

- What IP do we need to protect and how

-

IP Strategy

- How will we exploit the IP we have and to what effect

- How do we protect what needs protecting

- What IP do we need in the future

- How do we capture future innovations

-

IP watching & IP landscaping

Threats:

- Infringing on other people’s IP

- Others infringing on our IP

Opportunities:

- Identifying redundant technology/IP we can exploit

- Potential strategic partnerships/acquisitions

- Neutralising competition

- Establishing the “innovativeness” in your R&D to strengthen investment pitches

Our customers say…

Like with many companies, we are constantly busy and at the start of our journey with Visiativ, we weren’t sure if the effort would be worth the benefit. Luckily this wasn’t a feeling that lasted for long, as it was surprisingly straightforward and not as much paperwork as first expected. They also communicate directly with your accountant so the absolute minimal is

required from the client perspective.

Rod Wah, Managing Director, Beverston Engineering

Grant Funding in the Aerospace & Defence Industry

Explore grant funding opportunities from government bodies and private organisations and how they can provide support for research and development initiatives.

Government investment in the Aerospace & Defence industry

With recent reports that four of the top five recipients receiving the most funding from the UK Government’s innovation agency (Innovate UK) are in the aerospace industry, and the recent announcement of a £273 million investment to improve aerospace innovation technologies, the UK government is keen to encourage further investment in innovation in the aerospace industry. As a result, there are plenty of grant funding options available to help AD&S companies innovate and stay competitive

What activities are eligible?

European Innovation Council: Grants up to €2.5million for consortia of three or more with at least 2 members for EU states. Although there is a specific challenge for “space industries” other applications can be submitted through the “open call” stream which runs four times each year.

Defence & Security Accelerator: 100% grants up to £130,000 for the development of new technologies which may have defence or security applications.

NATEP: Grants for collaborative development of technologies with aerospace applications, consortia should include one potential end-user or customer.

DTEP: Grants for collaborative development of technologies with Defence applications

STEP: Grants for collaborative development of technologies with Space applications

What about loan funds?

Innovate UK Innovation Loans: Loans up to £2.0 million to support later stages of research & development. Each round of funding is focussed on specific technology themes. With flexible repayment terms and competitive interest rates.

DASA Defence Innovation Loans: Loans up to £1.6million for development and commercialisation of technology/products with defence applications. Again flexible terms and competitive interest rates.

What we can do for you

1. Grant Sourcing: We review all available sources to find the grant that is right for you, rather than opting for the most obvious one: Innovate UK, NATEP/DTEP/STEP/DASA and Horizon Europe/ European Innovation Council.

We look at all available forms of innovation support – other than grants:

- Knowledge Transfer Programme, Made smarter programme, and the Made Smarter Sustainability Accelerator

- Innovate UK Innovation Loans

- Defence Innovation Loans

2. Proposal writing & pitch preparation

- Justifying the case for grant funding

- Confirming innovativeness of proposals

- Explaining the value-add of successful projects to the wider community in the UK; the company, its collaborators, supply chain, industry sector.

Our customers say…

We chose to work with Visiativ because their scientific experts are able to understand the essence of our R&D work, capture it accurately and present it appropriately for HMRC R&D Tax Credit Offices. There is absolutely no way an accountancy firm could have grappled with our highly innovative science.

Angela Mathis, Chief Executive, ThinkTank Maths Limited

R&D Tax Relief for Aerospace and Defence companies

R&D tax relief schemes offer tax incentives for companies investing in innovation, reducing the financial burden associated with research and development activities.

The benefits of an R&D Tax Claim

You could receive tax credits or tax deductions for your research and development expenditures. This helps reduce the financial burden of innovation and could allow you to reinvest the saved funds into further R&D initiatives, further accelerating innovation within your business and propelling the aerospace, defence and space sectors forward.

The benefits extend beyond immediate cost savings, as the R&D tax relief promotes growth, drives competitiveness, and fosters a culture of continuous improvement within the industry.

Are you eligible for R&D tax relief?

Examples of qualifying activity for R&D tax relief in aerospace and defence:

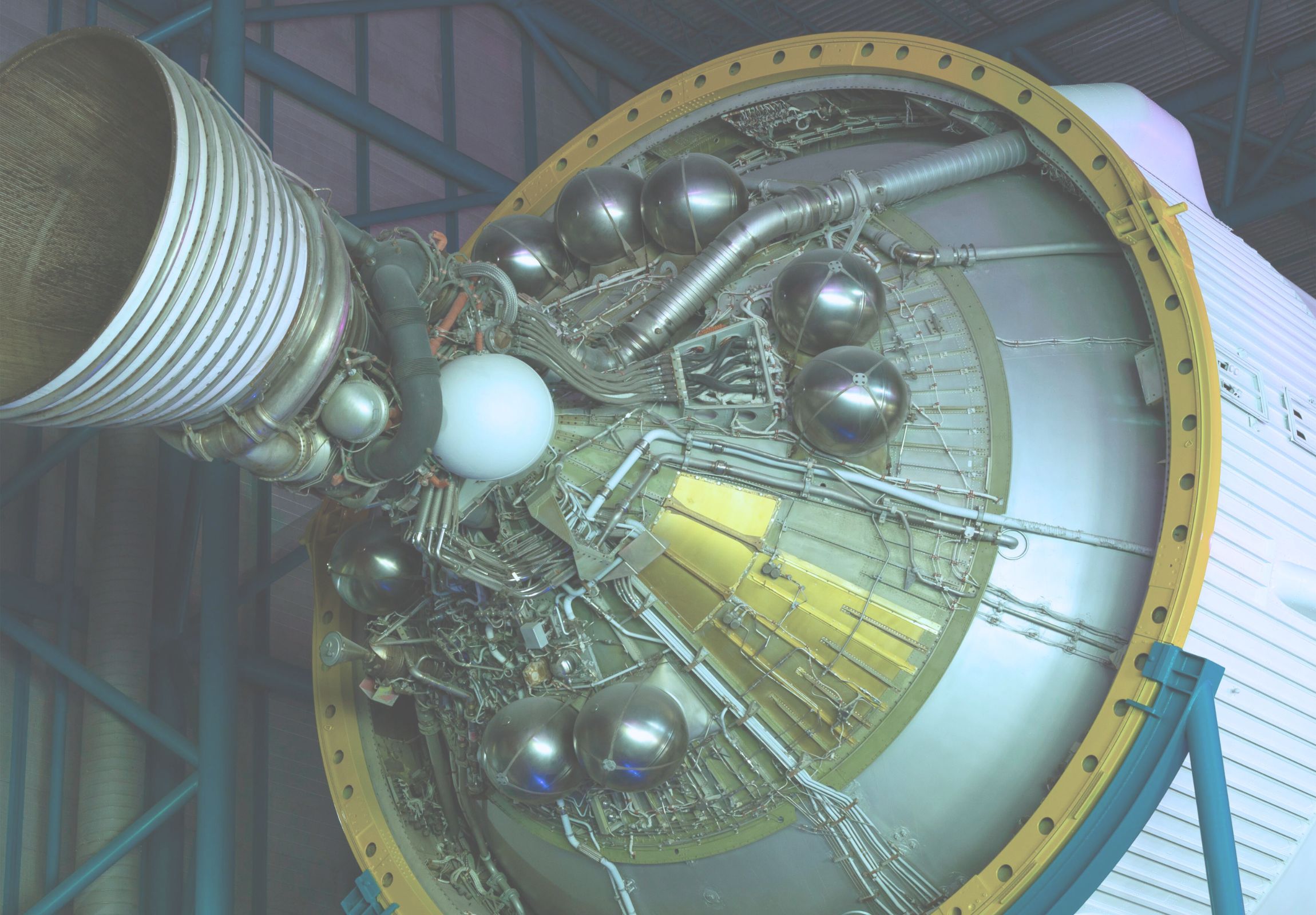

Development of advanced propulsion systems: designing and improving innovative propulsion technologies for use with sustainable sources of fuel (SAF, Hydrogen and electric), as well as engines with enhanced fuel efficiency or reduced emissions.

Materials research: Projects involving the development of new lightweight and high-strength materials for use in aircraft and defence equipment, such as composites or alloys with superior properties.

Unmanned Aerial Vehicles (UAVs) and autonomous systems: Research and development activities aimed at enhancing the capabilities of UAVs and autonomous systems, including navigation, control systems, and integration of advanced sensors.

Military equipment enhancements: Projects focused on improving the performance, durability, or efficiency of military equipment, such as armoured vehicles, communications systems, or weaponry.

Space technology advancements: Research and development initiatives related to space exploration, satellite technologies, and satellite communication systems, including the development of new satellite components, launch vehicles, or space exploration instruments.

What we can do for you

We help companies navigate the complexities of applying for innovation funding, ensuring that businesses already benefitting maximise their entitlement, as well as enabling those encountering the process for the first time to achieve a smooth route through it. We also manage the impact of grant funding and subsidies on R&D tax benefits.

Our Innovation Funding Consultants – highly professional post-graduate qualified scientists and engineers with experience in the aerospace and defence sectors – will gather all the information they need quickly and efficiently, peer-to-peer with your team. We write the Technical Report, collate all the eligible costs and calculate the associated benefit for inclusion in your company tax return. Lastly, we take care of any queries from the relevant tax authority as enquiry defence is included free-of-charge with every claim we submit.

Visit our R&D Tax Credits page to find out more.

Our customers say…

After working with the consultants at Visiativ, we recovered more than £60,000 from HMRC. We were absolutely delighted and are now working with them on further R&D tax credit submissions.

Craig Clark, Founder & CSO: Clyde Space

Patent Box Tax Relief for Aerospace and Defence companies

If you have a patent you could be eligible to claim through Patent Box. The UK government is keen to encourage creation of world-leading IP through R&D support and other targeted mechanisms such as Patent Box.

The benefits of claiming Patent Box

The Patent Box scheme is very generous. It allows eligible companies to apply a reduced rate of corporate tax (10% as opposed to the current 25%) to profits derived from the sale of products or services containing a qualifying patented innovation or IP – resulting in increased cash flow and improved financial performance. This encourages innovation and investment in R&D, as companies can enjoy significant tax advantages when commercialising their patented inventions.

The Patent Box also promotes the protection of intellectual property rights, as it incentivises companies to actively pursue patents and safeguard their valuable innovations. Overall, the Patent Box is a powerful tool for aerospace and defence companies to maximise the value of their intellectual property, drive competitiveness, and stimulate further technological advancements within the industry.

Are you eligible for Patent Box?

- Are you a UK-based company that pays UK Corporation Tax?

- Do you hold qualifying intellectual property rights, such as granted patents or exclusive licenses for patented inventions? These patents must be granted by the UK Intellectual Property Office, the European Patent Office, or certain other specified countries.

- Have you undertaken qualifying development activities related to the patented inventions? This includes activities like conducting research, designing, and developing the patented technology or its applications.

- Are you actively involved in exploiting the patented technology by actively licensing it, selling products incorporating the patented technology, or using the patented technology to generate income?

If you meet these criteria, you can register for the scheme and then calculate a “patent box profit” annually for each patent you are commercialising.

What we can do for you

We will assist in compiling and assessing associated costs and tracked profits from relevant patent protected products, and advise on:

- The implications of existing R&D eligible expenditure on calculation of relevant IP income;

- Managing corporation tax benefits of the combination of both R&D tax relief and Patent Box schemes;

- On-going legislative changes & impact on current or future patent box claims.

- We will prepare the Patent Box report and associated calculation for inclusion in your tax return.

View our Patent Box page to find out more.

Get in touch…

"*" indicates required fields

Find us

Consulting head office

6 Atholl Crescent

Edinburgh

EH3 8HA

Solutions head office

1 Pioneer Court

Chivers Way

Histon

Cambridge

CB24 9PT